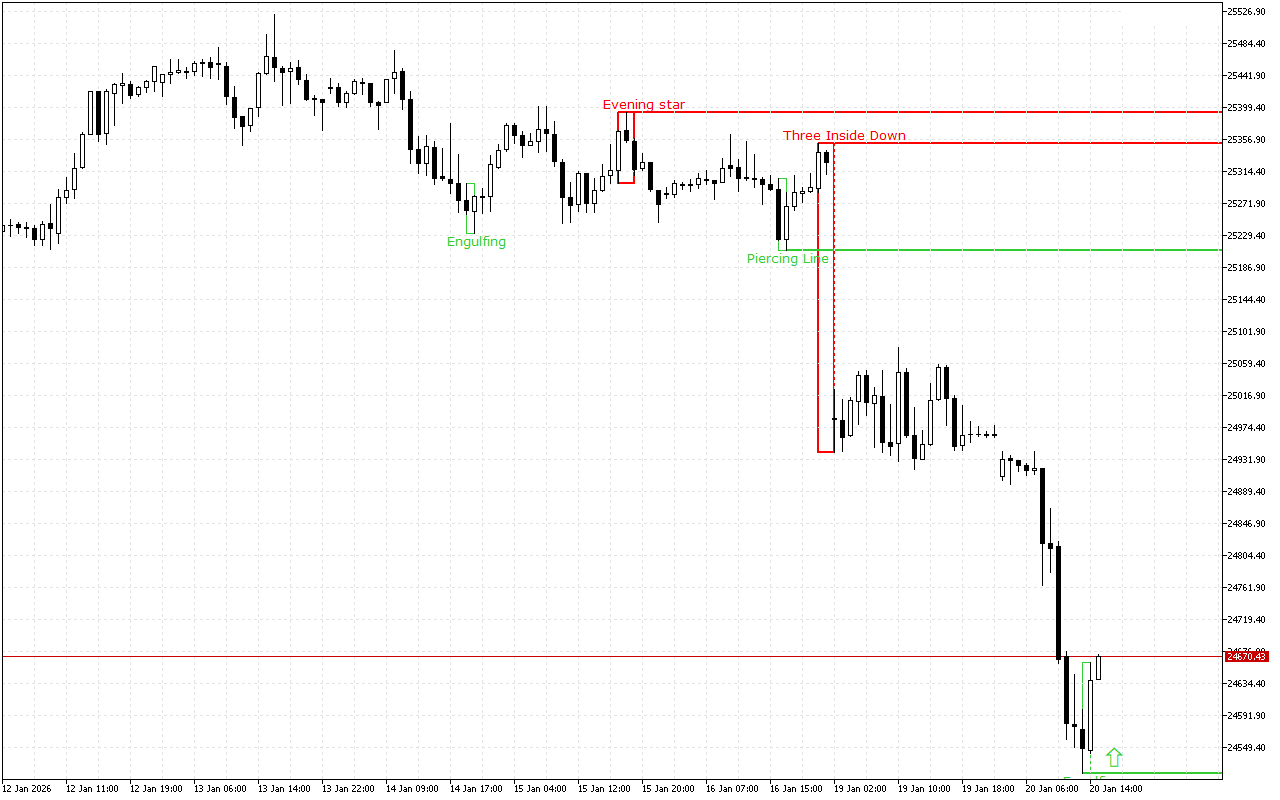

DAX 40 closes the last trading session in the green zone, while the downward price movement vector prevails on the higher time-frame.

The support and resistance levels:

The nearest support is set at the 24514.93 mark.

This level was formed by the Bullish Engulfing pattern. The pattern consists of two candles: the first one is inside the body of the second one, which is much larger. The second candle completely engulfs the first one.

The nearest resistance is set at the 25351.06 mark.

This level was formed by the Three Inside Down pattern. This pattern consists of three Japanese candles: the first candle has a short black real body, the second candle also has a black real body and is completely inside the body of the first candle, and the third candle is also black and closes below the body of the second candle.

Trading recommendations:

Despite the downward dynamics prevail on a higher time-frame, the long position should be prioritized intraday. The latest signal on the chart indicates the prevalence of the upward movement intraday.

DAX 40 H1: The Price Action Forecast for the American Session on 20.1.2026