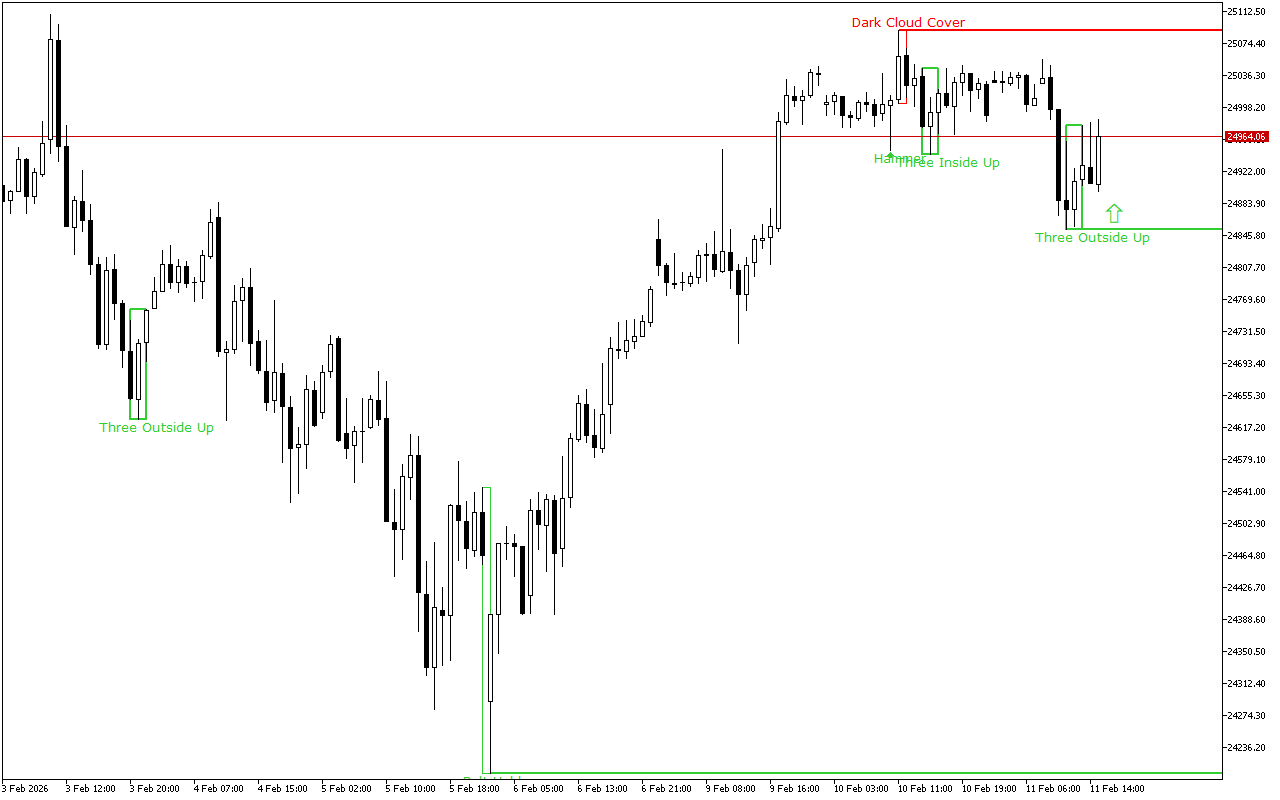

During the previous trading session, DAX 40 demonstrated downward dynamics. On a longer time-frame, the upward trend still prevails.

The support and resistance levels:

The nearest support is set at the 24853.06 mark.

This level was formed by the Three Outside Bars Up pattern. The pattern consists of three Japanese candlesticks: the first candlestick has a short black real body, the second candlestick has a long white real body and completely engulfs the first candlestick, and the third candlestick is also white, closing above the second candlestick.

The nearest resistance is set at the 25089.77 mark.

This level was formed by the Hammer pattern, also known as the Pin Bar pattern. This pattern is represented with a single Japanese candlestick which is composed of a small real body and a long lower shadow.

This level was formed by the Dark Cloud Cover pattern. The pattern consists of two candles: the first candle is long and white, and the second is black. The second one opens with a gap up and closes below the middle of the real body of the first candle.

Trading recommendations:

The price movement dynamics for a longer period of time as well as the latest signals on the chart indicate the long positions opening intraday. The entry points can be considered from the nearest support levels.

DAX 40 H1: The Price Action Forecast for the American Session on 11.2.2026